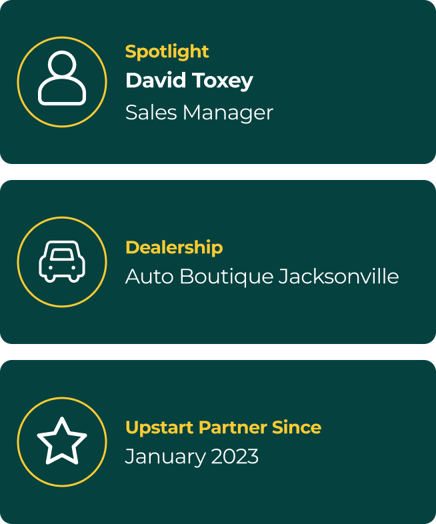

David Toxey brings years of automotive sales and financing expertise to his role as Sales Manager at Auto Boutique Jacksonville. As a champion of Upstart’s AI-powered Financing solution, Upstart Auto Finance, David has enabled his team to boost profits for the dealership by winning more deals, generating more back-end gross and providing more flexible financing options without the lengthy back-and-forth process with traditional lenders.

Closing more deals with AI

In an environment where rigid credit criteria and slow underwriting calls cost dealers sales and frustrate shoppers, David needed a financing solution that could secure fast, competitive offers without slowing down his team.

He answered that challenge with Upstart Auto Finance, which evaluates over 1,000 data points to produce instant, competitive loan offers 24/7.

Upstart has taken half the business from some of our other lenders. Upstart gives us better rates, and most of the time, Upstart gives us better back-end profits. Upstart doesn’t stip us for everything under the sun. We’re definitely selling more cars.

For many of Auto Boutique’s consumers, who have credit scores 600 and above, David reports that Upstart is approving almost all of those deals, keeping the dealership’s pipeline flowing and customers moving in and out of the finance office efficiently.

Instant, data-driven decisioning

From April to June 2025, Auto Boutique Jacksonville has funded 75 deals1 with Upstart, without sacrificing speed or service.

“I love the Upstart product, and it makes it easy for me because I’m able to get a response within seconds. I don’t have to go through the lender submission process; I just see the opportunity and can pencil the deal from there.”

Flexible deal adjustments

David called out that the flexibility of Upstart’s financing has increased overall customer satisfaction. Since Upstart performs soft credit pulls that provide customers with financing terms without impacting their credit score, customers feel more comfortable that their credit scores aren’t impacted to see their finance options. This also enables the sales team to help customers find the cars they can afford.

Additionally, in the case where a customer needs to change to a lower down payment, Upstart remains adaptable.

“Most of the deal structure is pretty good. If the customer is changing a down payment, Upstart is really flexible. Most of the time with a bank, you’ll get a conditional approval if you lower that down payment.”

The next-day funding advantage

Finally, the speedy time-to-fund has enabled the dealership’s F&I teams to keep the deals moving with confidence.

“The funding with Upstart is always great; I’ve seen a deal get funded in 2–3 hours. That makes everyone in finance love Upstart – you don’t have to chase down funding.”

Dedicated, proactive support

Beyond the technology, David credits his daily communication with his dedicated Upstart Dealer Success Manager, who’s always available to answer questions or concerns.

“I’m an Upstart fan, and Josh is very involved in our dealership. We communicate every day, and he’s always readily available.”

High approval consistency

“For credit scores 600 and higher, Upstart approves about almost all of those deals.”

Better rates and fewer stips

“Upstart gives us better rates, and almost all of the time, Upstart gives us higher back-end profits. Upstart doesn’t stip us for everything under the sun.”

Flexible structuring

“I can change to a lower down payment amount with Upstart and still get a reasonable response.”

Fast responses

“I’m able to get a response in seconds. I don’t have to go through the lender submission process.”

Rapid funding

“Most deals get funded in 2–3 hours2

—everyone in finance loves it.”

Hands-on partner

“Our Dealer Success Manager, Josh, is very involved in our dealership. We communicate every day, and he’s always readily available.”

Source: https://www.chevrolet.com | https://www.nissan.com

Ready to boost profits and speed up financing?

Download the full Auto Boutique Jacksonville Spotlight

1Findings reported are based on information collected by Upstart from April-June 2025.

2Average funding time in Q2 2025 was 3 business days.

Want to see what Upstart Auto Retail can do for your dealership?