The leadership team at CARite, a leading independent dealership in Orlando, Florida, knew that tightening credit and rising consumer expectations necessitated a strategy shift. Amidst the high interest rate environment of 2024, it was becoming increasingly difficult for customers to secure financing. Plus, consumers wanted to buy on their own terms – requiring a blend of online and in-store experiences, as well as more upfront transparency when it came to pricing and vehicle information.

Hybrid shopping and pricing transparency are king

The team at CARite recognized that, while fully online car purchasing was not widely preferred, a hybrid online and in-store model was more suitable. Customers could then gather their information online, but finalize deals and test drive vehicles in-person. “In reality, there’s very few customers, especially in the used market, that want to be entirely ‘hands-off.’ They want a hybrid version,” said Alex Balk, General Manager at CARite. “They want information, like financing terms, upfront, and then come in to do the final paperwork and test drive.”

CARite turned to Upstart to ensure that customers had access to detailed information about car pricing, fees, taxes and financing options before visiting the dealership, streamlining the buying process for all.

Additionally, Upstart’s AI-powered financing provides instant loan approvals and competitive rates by analyzing a broader range of customer data beyond traditional credit scores. By leveraging AI, the dealership could offer customers clear financing terms upfront, reducing the uncertainty and friction typically associated with car financing. This transparency is helping both the customer and dealership by aligning expectations early in the buying process.

Credit has been tighter than I’ve ever seen it. With AI lending, you can get more competitive rates.

Alex Balk

General Manager at CARite

More flexible financing and a better experience for all

Faster deal cycles and higher profits:

In the current high interest rate environment, CARite is now able to move metal efficiently through a combination of following sales trends and leveraging the Upstart platform. By monitoring sales trends and leveraging Stockwave to see which car types are in demand, leaders at CARite are able to manage their inventory efficiency, acquiring and reconditioning inventory quickly to meet the needs of the market. For example, the dealership stocks commercial vans towards the end of the year for tax-driven purchases. This approach reduces days in inventory and accelerates the cash flow cycle, allowing for constant reinvestment in new stock.

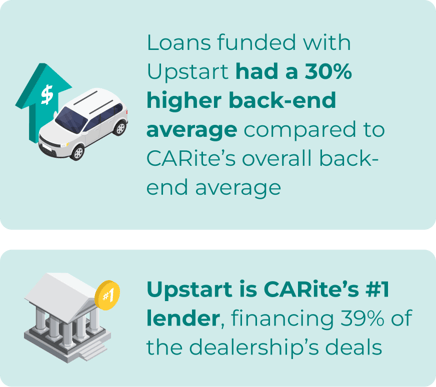

Combined with Upstart’s transparent and streamlined buying process, CARite has seen an increase in sales despite high interest rates, with a higher back-end profit. Loans funded with Upstart have on average a 30 percent higher back-end compared to CARite’s overall average back-end, with $940 per deal versus $719 per deal.1

“The whole name of the game is speed, right? You want to sell cars as fast as possible, and part of selling them is getting financing done – anyone can put a car on the road, but you have to get the deal cashed,” Balk said.

More flexible loan options:

With access to credit tightening, CARite has also leveraged Upstart’s AI-powered financing to secure better financing options for a wider range of customers, enabling them to maintain high sales volumes. In fact, Upstart is CARite’s #1 lender, financing 39 percent of the dealership’s deals in the last three months.2

“Credit has been tighter than I’ve ever seen it. With AI lending, you can get more competitive rates. Plus, we know approval time kills deals. By having instant approvals and knowing the stipulations upfront, it reduces frustration for both the customer and the salesperson,” Balk explained.

Enhanced satisfaction and operational efficiency:

Balk shared that Upstart has improved the overall customer and employee experience, leading to higher customer satisfaction and repeat business. Combined with advanced inventory management and quick turnover strategies, CARite has reduced the time cars spend in inventory, improving the dealership’s profitability and responsiveness to changing market trends.

1Findings reported are based on information collected by CARite and reported to Upstart from April 20-June 20, 2024. The overall back-end average includes all deals, including cash.

2Findings reported are based on information collected by CARite and reported to Upstart from April 20-June 20, 2024. 87 out of 133 retail units sold in the last 90 days were financed, with Upstart financing 34 of those deals.

Download the full CARite case study

Want to learn about CARite’s success on the go? Check out Alex’s interview on the Leadership in the Dealership podcast.