%201.png?width=262&height=67&name=Schafer%20Chevrolet%20logo%20(1)%201.png)

AI-Financing Spotlight: Jared Kucheck

“Our F&I numbers are higher than ever”:

How Schafer Chevrolet Found a Smarter Way to Finance More Buyers

As General Manager of Schafer Chevrolet, Jared Kuchek knows what it takes to succeed in a small town dealership. Located in Pinconning, Michigan — Schafer is known for its no-haggle pricing, honest service, and deep customer loyalty.

That focus on trust and transparency extends into every part of the business — including financing. So when Kuchek heard about Upstart Auto Finance, he saw an opportunity to simplify the process, expand approvals, and help more customers drive away happy. “Upstart filled the exact hole we needed filled,” Kuchek said. “They said they could go higher on LTV, use AI instead of pure credit score, and still pay strong reserve — and they’ve delivered on all of it.”

A Top-Performing Lender from Day One

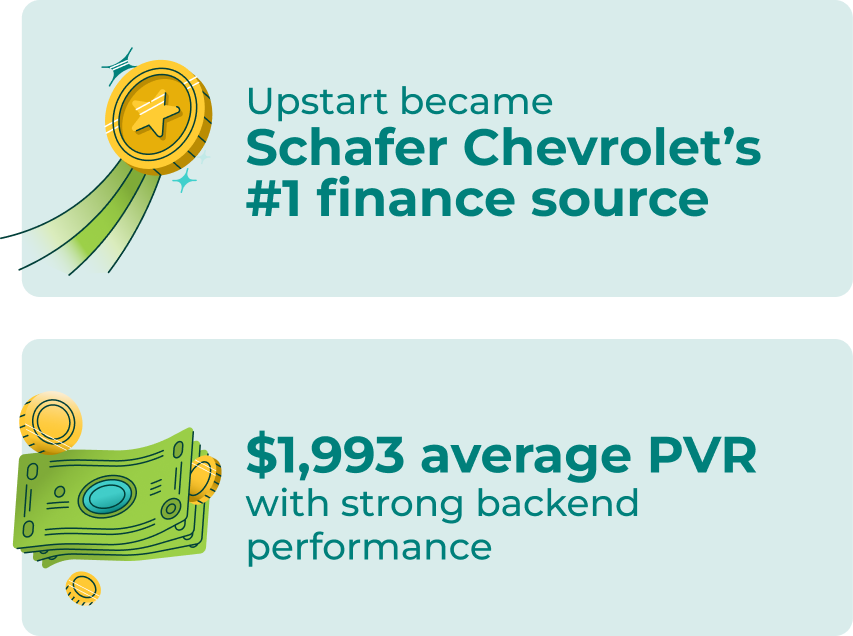

After launching with Upstart in July 2025, Schafer Chevrolet quickly saw it become a key player in the store’s lender mix. “They quickly became our number-one finance source,” Kuchek said. “We’re getting approvals we never would have gotten before, and they’re buying deals intelligently — looking at the customer’s ability to repay, not just the credit score.”.

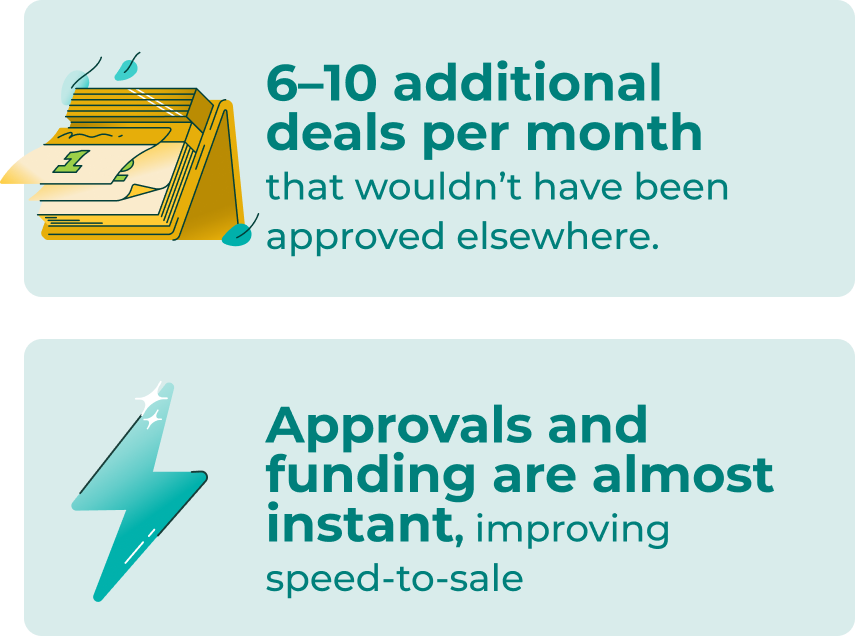

In just a few months, Upstart has helped Schafer close deals across the full credit spectrum — including buyers with significant negative equity. .

“Everything we wanted, they’ve delivered–– and they’re still improving... Upstart’s been awesome to work with.”

Profitable Results Across the Board

Kuchek highlighted Upstart’s speed and efficiency as major wins for his team. “Approvals and funding are almost instant — perfect,” he said. “It’s hands down the easiest platform in the industry.”

In the three months since launching, Schafer Chevrolet has completed 67 Upstart-financed deals, generating strong results across both volume and profitability. “Our F&I numbers are higher than ever,” Kuchek said. “We’re seeing strong reserve, great backend, and approvals that let us deliver more cars. It’s been extremely beneficial.” Upstart-financed deals averaged $1,993 PVR, outperforming GM Financial’s $1,890 PVR while delivering nearly twice the volume.

He also noted Upstart’s flexible buy box as a key contributor to that profitability. “They’ll go higher on LTV for good-credit customers and give fair rates to lower-credit customers with strong income,” he said. “That balance lets us win more deals without sacrificing margin.”

A Partnership That Keeps Improving

For Kuchek, what stands out most is Upstart’s responsiveness and steady improvement over time. “Everything we wanted, they’ve delivered — and they’re still improving,” he said. “Our finance numbers are the highest they’ve ever been..they buy smart, they fund fast, and they’ve made a huge impact on our store.”.

The Bottom Line

With Upstart Auto Finance, Schafer Chevrolet is closing more deals, approving more buyers, and driving stronger profitability across the board..

Source: https://www.chevrolet.com

Drive your dealership forward

Ready to boost PVR, close more deals and delight customers with AI-powered financing?

11Findings reported are based on information collected by Schafer Chevrolet from July 2025.

Want to see what Upstart Auto Retail can do for your dealership?