Jamin Van Sickle is the Store Manager at the West Auto Sales West Valley City location in Utah. Known for his patient, no-pressure approach, he’s consistently praised by customers for prioritizing fast, friendly and transparent financing.

Closing more profitable deals with AI

West Auto Sales needed a way to better serve first-time and thin-file buyers: groups that often face slow approval processes and steep terms. At the same time, the dealership wanted to increase profitability while delivering its trademark speed-to-close.

To serve its traditional customers as well as those often overlooked car buyers, West Auto Sales uses Upstart Auto Finance to deliver AI-powered credit decisions that use thousands of data points beyond traditional credit scores, leading to rapid approvals and competitive rates. This capability has opened the buy box to customers who might otherwise walk away, without sacrificing speed or margin.

“Upstart turns what could be frustrating into something amazing by giving first time or thin-file buyers better rates than they would get elsewhere,” Van Sickle said. “Upstart’s funding is amazing. The response rates are really fast, and the process is smooth,” he continued.

"Upstart’s funding is amazing. The response rates are really fast, and the process is smooth"

Immediate results after two months

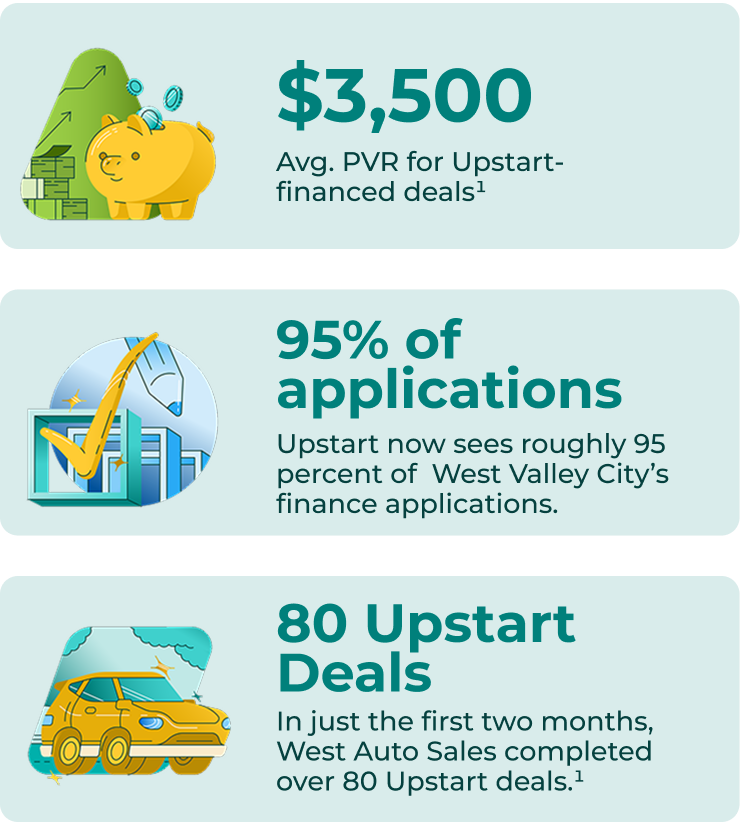

Profitability: Upstart-financed deals have delivered strong back-end performance with an average PVR of $3,500 compared to the dealership’s goal of $3,000, representing a $500–600 gain per deal versus other lenders.

First look, fast approvals: Upstart now sees roughly 95 percent of West Valley City’s finance applications, making it virtually the dealership’s first-look lender. “If a customer is here in the store, it’s going to be an Upstart deal because it’s super easy and super fast,” Van Sickle said.

High volume, high growth: In the first two months since rolling out Upstart Auto Finance, West Auto Sales has completed over 80 Upstart deals, with Upstart accounting for 10-15 percent of the total business.

Customer experience and speed: Fast financing has transformed the in-store experience, especially for first-time and thin-file customers. “Customers always tell us how quick we are. Now, we don’t have to tell customers to come back when they’ve put money down or to come back with a qualified cosigner. Now, we’re actually getting the customer sold at a much higher percentage when they’re sitting right there, and they’re doing a deal with us as opposed to going to a dealership down the road,” explained Van Sickle. Even further, e-contracting and rapid funding ensure that deals close without friction, solidifying the dealership’s reputation for getting customers in and out of the store quickly. “We’re not the kind of dealership to keep people there for three to four hours. We’re all about speed and getting customers out as fast as possible, and Upstart helps us speed up the process so it’s really helpful for everyone.”

“We’re all about speed and getting customers out as fast as possible, and Upstart helps us speed up the process so it’s really helpful for everyone.”

Drive your dealership forward

Ready to boost profits and speed up financing?

Download the full AI-Financing Spotlight

1Findings reported are based on information collected by West Auto Sales from June-August 2025.

Want to see what Upstart

Auto Retail can do for your dealership?

Auto Retail can do for your dealership?